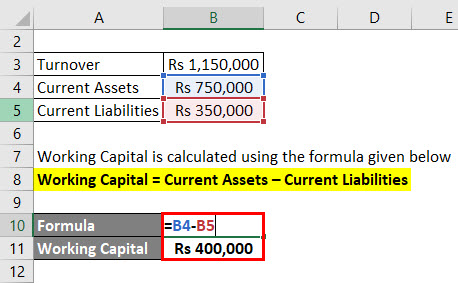

Working capital turnover ratio is an analytical tool used to calculate the number of net sales generated from investing one dollar of working capital.Working Capital Turnover Ratio Conclusion Just like other measures, working capital inventory ratio varies widely across and between industries and companies therefore, for comparison purposes, compare a company’s working capital turnover ratio against the industry’s average or against their own historical data. The inventory becomes outdated and accounts receivable becomes written off as bad debt. Thus, too many accounts receivable are generated. Hence, they’re taking longer to be converted into cash leading to sales on credit. When the ratio is low, it implies that the goods can’t be traded. Meanwhile, a low ratio is a sign of power management of the business resulting in the accumulation of inventories and accounts receivable. The ratio can as well be interpreted as the number of times in a year working capital is used to generate sales.Īs a rule of thumb, the high ratio shows that the management is efficiently utilizing the company’s short term assets. It reveals to the company the number of net sales generated from investing one dollar of working capital. It’s used to gauge how well a company is utilizing its working capital to generate sales from its working capital. Working capital turnover ratio is an efficiency and activity ratio. This means that for every one dollar invested in working capital, the company generates $2 in sales revenue. This company has a working capital turnover ratio of 2. $$Working\: Capital\: Turnover = \dfrac = 2$$ This could be associated with the risk of stocks being outdated and accounts receivable being bad debts and being written off. A high ratio indicates that the company is making sales with very little investment.Ĭonversely, a low ratio implies that the company invests in accounts receivable and inventories to support its operations. This means that the company is majorly depending on its working capital to generate revenues. Simply put, it’s that amount in hand in excess of current liabilities.Ī high working turnover ratio is an indicator of the efficient utilization of the company’s short-term assets and liabilities to support sales. This ensures that everything is operating smoothly. Working capital refers to the cash at hand in excess of current liabilities that the business can use to make required payments of its short term bills. It is the amount of money that ensures that the business can pay its short term debts and bills like employees’ salaries. Working capital is very instrumental in running the day-to-day activities of a business. In other words, this ratio shows the net sales generated as a result of investing one dollar of working capital. Working capital turnover measures how efficiently the company is utilizing its working capital to produce a certain level of sales. This ratio shows the relationship between the funds used to finance the company’s operations and the revenues a company generates in return.

Working capital turnover, also known as net sales to working capital, is an efficiency ratio used to measure how the company is using its working capital to support a given level of sales.

0 kommentar(er)

0 kommentar(er)